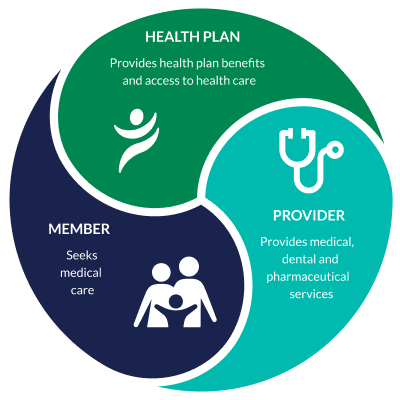

How Health Plans Work

The U.S. healthcare system is complex. You’ll get the most value for your money if you understand basic insurance words and concepts.

The U.S. healthcare system is complex. You’ll get the most value for your money if you understand basic insurance words and concepts.

Use in-network healthcare providers for the greatest savings. If you use out-of-network providers, you may pay more.

Create an online account to see all your benefits, track your spending, find a doctor, and more.

Some benefits (like preventive care) are covered at 100 percent by your plan (that means they’re free to you). You should expect to pay part of most medical services you receive.

Know your health plan network

Your health plan network is the group of doctors, hospitals and other providers who contract with LifeWise to offer services and supplies at a discounted rate.

Save money by staying in network

You pay less for care when you see a healthcare provider in your plan network.

Find an in-network provider

Sign in to your account and use the Find Care tool. Browse by category for fast results. You can also compare procedure costs.

It protects you from paying the full cost of care when you are sick or injured. Your plan determines where you get care and how much you pay for it.

We pay for your healthcare together. Your plan determines how much you pay out of pocket.

The Affordable Care Act (ACA) is a federal law that governs healthcare in the United States. Your plan also includes birth control coverage, breastfeeding coverage, dental coverage, and vision coverage.

LifeWise Assurance negotiates with high-quality providers to give you high-value care at a reasonable price. Avoid extra costs by choosing in network providers.

Benefits are health products and services your plan covers—subject to copay, coinsurance, or deductible. Services include emergency care, pregnancy, mental health, prescription medication, and more. To see your specific plan’s benefits, sign into your account and review your benefit booklet and summary of benefits. You can also ask UW or LifeWise customer service.

Preventive care is covered in full (free to you) on ISHIP and GAIP plans.

You had a few doctor visits and reached your deductible.

Your plan now begins paying most of your qualified medical costs.

You have seen the doctor several times and have paid $5,000 out of pocket this year.

Now your plan will pay the full cost of your qualified medical costs this year (and any more care you receive after this point will be free to you).

The above numbers are an example only. Refer to benefit booklet for actual costs for your plan.